Patel Engineering: Share price fluctuates

September 20, 2024 – Patel Engineering Limited (PATELENG), a prominent Indian infrastructure company specializing in hydropower, irrigation, and tunneling projects, has experienced a volatile year in terms of share price. This article dives into the factors influencing PATELENG’s stock price, explores the company’s recent performance, and analyzes its future prospects.

Patel Engineering’s Share Price Journey

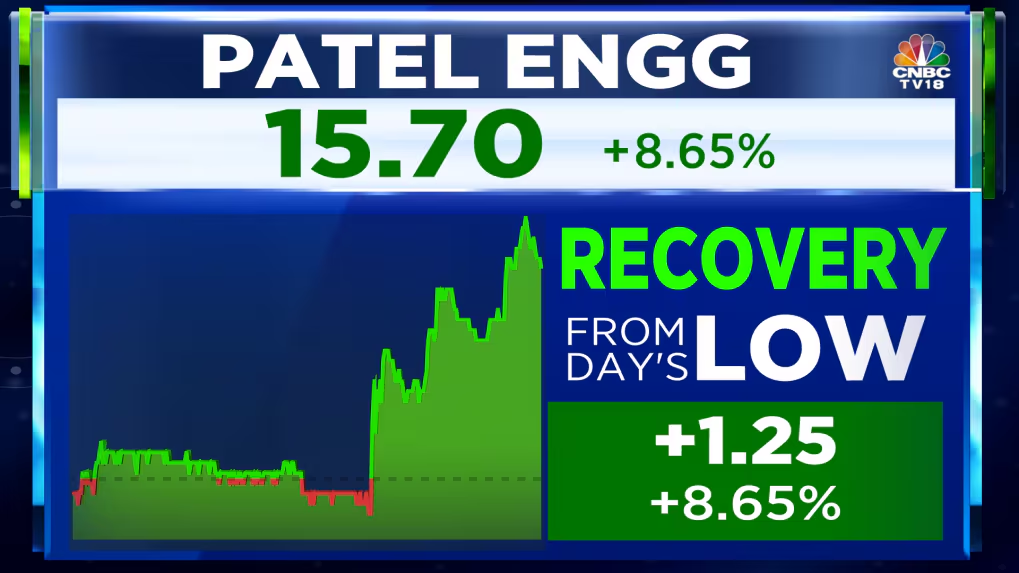

As of September 20, 2024, PATELENG’s share price sits around ₹57.50. This represents a slight decrease compared to its price at the beginning of 2024 (around ₹65). However, the story is more complex when looking at the year’s highs and lows. PATELENG reached a peak of ₹79 in March 2024, followed by a significant dip before a slight recovery in recent weeks.

Understanding the Fluctuations: Factors at Play

Several factors contribute to Patel Engineering’s share price movements:

- Market Conditions: The overall health of the Indian stock market significantly impacts individual stocks. Economic fluctuations, global events, and investor sentiment can cause market corrections, leading to price changes for PATELENG alongside other companies.

- Company Performance: PATELENG’s financial performance, order book size, and project execution capabilities directly influence investor confidence. Strong financial results and a robust order book can drive the share price upwards.

- Industry Trends: Trends within the infrastructure sector can affect PATELENG’s stock price. Government spending on infrastructure projects, competition in the sector, and the demand for hydropower and irrigation projects can all play a role.

- Company News and Announcements: Any major news from PATELENG, such as project delays, contract wins, or strategic partnerships, can trigger share price movements.

Patel Engineering: A Look at Recent Performance

Despite the fluctuating share price, Patel Engineering has secured some noteworthy achievements:

- Order Book Growth: The company’s order book has grown steadily in recent years, indicating healthy project acquisition and future revenue potential.

- Focus on Hydropower and Irrigation: PATELENG is strategically focused on hydropower and irrigation projects, which are crucial for India’s energy and water security. This alignment with government priorities could benefit the company in the long run.

- Focus on Diversification: While hydropower and irrigation projects remain core areas, PATELENG is exploring diversification into other infrastructure segments, potentially reducing reliance on a single sector.

The Future of Patel Engineering: Reasons for Optimism

Despite the current market volatility, several factors suggest a potentially bright future for Patel Engineering:

- Government Infrastructure Push: The Indian government’s continued focus on infrastructure development creates a favorable environment for companies like PATELENG. Increased spending on hydropower and irrigation projects can translate to more contracts and revenue.

- Experienced Management: PATELENG boasts a team with extensive experience in the infrastructure sector. This expertise could be crucial for navigating market challenges and securing future projects.

- Strong Brand Reputation: The company has established a strong reputation for quality and timely project execution, which can attract new clients and strengthen its position in the industry.

Patel Engineering: A Stock Worth Considering (with Caution)

While Patel Engineering’s future holds promise, investors should exercise caution before investing. The current market volatility and the cyclical nature of the infrastructure sector present risks. It’s crucial to conduct thorough research, consider individual risk tolerance, and potentially consult a financial advisor before making investment decisions.

Looking Ahead: Patel Engineering Navigates a Changing Market

Patel Engineering’s future success depends on its ability to navigate current market fluctuations, secure new projects, and capitalize on India’s growing infrastructure needs. The company’s performance in the coming months and years will be closely monitored by investors and industry analysts alike.